Building an Effective Go-to-Market Engine

In this episode, Anthony Enrico talks about revenue operations and how teams can build a solid GTM engine - which can help them generate sustainable, predictable revenue that scales.

Stop reacting to churn. Start predicting it. Download the 2025 Guide to Churn Forecasting

Anthony is the CEO and co-founder of LeanScale and has more than a decade of experience in GTM and RevOps roles in the B2B SaaS industry, the knowledge from which is used to help other B2B SaaS companies to scale their GTM engine by streamlining RevOps.

In this session, Anthony talks about revenue operations and how teams can build a solid GTM engine that can help them generate better revenue results. He also explains three metrics that every RevOps team should be looking at to gauge and improve their performance.

The metrics discussed:

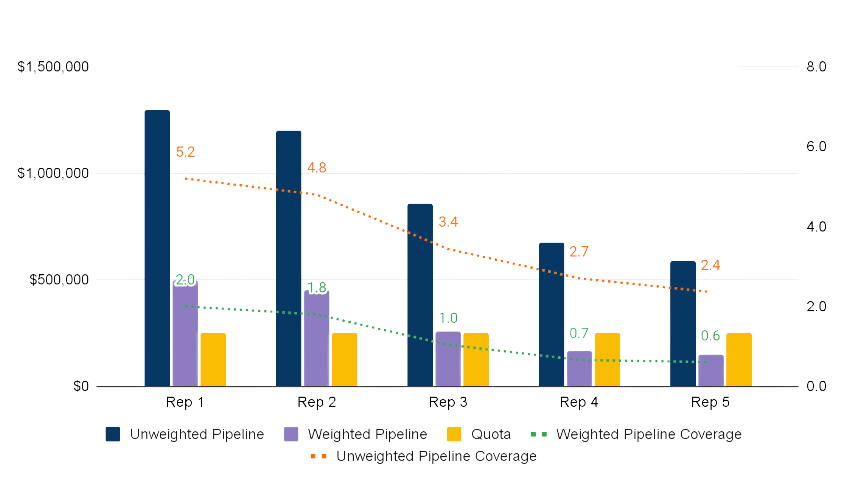

- Pipeline Coverage by Rep: understanding rep performance by calculating the ratio of weighted to unweighted pipeline by rep to period quota

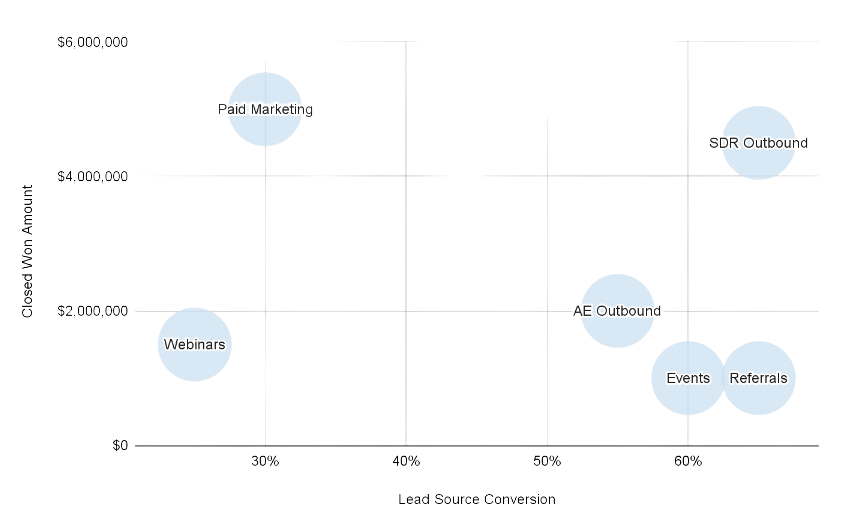

- Lead Source Impact Matrix: gauging the performance of your marketing channels using a matrix

- Forecast Sensitivity Analysis: knowing the bounds of possibility of your revenue in the coming year

Metrics and data are crucial for RevOps and analytics roles

Metrics and data enable professionals to measure performance, identify areas of improvement, and align strategies to drive revenue growth, ultimately leading to enhanced operational efficiency.

Understand performance and make informed investments

Metrics like lead coverage and lead source impact matrix help identify performance gaps and inform investment decisions, whether it's aligning marketing spend or optimizing territories.

Communicate potential outcomes and avoid surprises

Utilize forecasting sensitivity to provide realistic narratives and expectations. Effective communication of performance outcomes early on helps align expectations, control the narrative, and avoid surprises.

{color=#FFFFFF, opacity=100, rgba=rgba(255, 255, 255, 1), rgb=rgb(255, 255, 255), hex=#FFFFFF, css=#FFFFFF}

The "Pipeline Coverage by Rep" is a pivotal sales metric evaluating the proportion of each rep's weighted and unweighted pipeline coverage to their specific period quota. It ensures optimal sales force investment and efficient territory allocation.

By tracking each rep's performance, businesses can promptly identify top performers and areas needing improvement. This valuable insight allows effective investment distribution, targeting territories with the most opportunities, and avoiding over or under-investing in the sales team. "Pipeline Coverage by Rep" simplifies complex metrics, helping businesses focus on what truly matters - maximized revenue.

{color=#FFFFFF, opacity=100, rgba=rgba(255, 255, 255, 1), rgb=rgb(255, 255, 255), hex=#FFFFFF, css=#FFFFFF}

The "Lead Source Impact Matrix" is a strategic sales metric, plotting lead sources against conversion rates and closed-won opportunities. This tool guides expenditure decisions for each lead source and facilitates efficient channel diversification.

Based on quadrant analysis, businesses can strategically fuel top-performing sources, invest in promising ones, decrease spending on underperforming sources, or ignore the least effective. The "Lead Source Impact Matrix" offers a nuanced view of each lead source's elasticity and performance, promoting a balanced approach to lead generation.

{color=#FFFFFF, opacity=100, rgba=rgba(255, 255, 255, 1), rgb=rgb(255, 255, 255), hex=#FFFFFF, css=#FFFFFF}

The "Forecast Sensitivity Analysis" is a critical business metric that uses sensitivity analysis with created pipeline and SQL to CW conversion factors. This analysis tool aids in planning investments according to probable forecast scenarios and communicating potential performance outcomes.

Employing this tool can eliminate unrealistic expectations from forecasting by illustrating both the highest potential gains and potential risks. The "Forecast Sensitivity Analysis" ultimately helps businesses avoid major surprises, establishing the boundaries of possible outcomes for informed decision-making.

MATT DURAZZANI: Hello everyone! And a special welcome to Anthony Enrico. We're very excited to have you today. You're a great addition to our Revenue Maverick program. So welcome.

...

I'm Matt Durazzani, your host and I'm a Revenue Maverick adviser. And for the audience, I will love to introduce you for a moment to Anthony. He is currently the CEO and founder of leanscale. Anthony spent his career in operations in a number of organizations. and in those experiences he realized the need for expertise that are unique to this type of role, and after a decade spent solving similar problems and always new ones. He decided to start his own organization, to be able to serve more businesses and spread his knowledge and advisory work to others.

Anthony, today for the program, we would like to hear from you a little bit briefly about your organizations, and how people can get in touch with you. And then we would love to transition to understanding how you look at revenue engine holistically, as well as sharing with ours the 2-3 metrics that you felt you wanted to share with the community today. So, without further ado, the floor is yours

ANTHONY ENRICO : Well, Matt. First of all, thank you so much for having me. Really excited to be working with you on Revenue Maverick, and I think this is a really a really important topic that a lot of people are interested in. So I'm happy to provide some context here on the Revenue Operation side. I could give a little bit more background, so people know how I got into revenue operations. I think that's interesting for a lot of people, since it's fairly new. But I had a eclectic background, and in B2B SaaS Go-to-market role. So a little bit of sales, a little bit of customer success, a little bit of marketing, and then eventually found my way in a formal RevOps role, which I always have an interest in the operations side of any role I was in, and took my role as an operator. So that's how I got into it. I think that might be interesting for people who are trying to break into revenue operations, or you may be a leader in a go-to-market team looking for your next revenue operations upcoming star as well.

MATT DURAZZANI : I think that's a very good point that you, You were explaining the fact that sales operations is not the only route, you can come from other backgrounds but ultimately to be very well rounded, you want to have an experience in solving and supporting those different pillars in the organization

ANTHONY ENRICO : Absolutely, absolutely. And if you have some experience in the field. I think it helps you build a lot of empathy for the teams that you're helping support. So if you're in a sales or CS or marketing role right now, looking to get into operations, I think It's definitely a good avenue. You don't have to start there for sure.

And, Matt, I can give you a little bit of background on me, too. So some of the stuff I present this may give more context to how I view the world. So, as Matt mentioned, my co-founder and I, started lean scale after we had done revenue operations at a few different startups, and began to see the repeatability of some of the processes we were leveraging, and we also knew that it took a few different skill sets to set up the whole foundation really well. In particular, somebody who is technically sound with the systems, so usually that salesforce or Hubspot being able to connect all the go-to-market tools, and then someone who can think about the business holistically and understand how the processes should be operating. And how do you report on a business to articulate the performance of the go-to-market engine that you're building? So those 2 skill sets, I didn't have both, I was always on the business process side, and reporting an analytics side, new enough to be dangerous on salesforce and Hubspot, but definitely wouldn't consider myself a a pro on that side. So what leanscale does is we combine 2 types of people to provide a full RevOps operating team for our customers. So you could think of it as robots as a service, fractional RevOps.But we focus on B2B companies that are looking to grow and scale, and help take the whole operational burden off the plate of the go-to-market teams, and then empower them with all the data they need to make business decisions

MATT DURAZZANI : Awesome! Thank you.

ANTHONY ENRICO : Well, now, I think I could start if you think it's a good time with what I think RevOps is, because it's a little nascent. I think it's still, it's a new business function. People are still trying to define what it means and what it is, and everybody has their own definition, but I can share mine for what it's worth.

MATT DURAZZANI : Yeah, please do

ANTHONY ENRICO : So I've always thought of revenue operations. One, I think there's a big distinction between Sales Ops, Marketing Ops, CS Ops, and then full RevOps. Full RevOps from my perspective is looking holistically at the business - the whole lead to cash process, the customer management process and journey. And then, making sure that you have systems set up that can support the entire go to market engine, which is a big responsibility. I think it's been developed because a lot of processes and tools get siloed within some of those go-to-market functions and often it creates a lot of in-fighting within teams. It creates a lot of issues with reporting and definitions. So we're seeing RevOps continue to to build and grow. And for me I think there's 3 main areas that a RevOps team should function in. I'm going to start with obvious one. I'm going to start in the middle. So the operations aspect of it, meaning do processes align? How do people do the things that they do? How are compensation plans set up? How are the tools connected? Which tools are you using? What's the overall tech stack strategy? So all of the processes, systems, and tools definitely something that needs to be owned by revenue operations and help see across all the departments and understand how the whole flow should work. That's clearly a core competency. The other aspect, I think is just as important, is the go-to-market analytics. So having a function that sits across all of the other go-to-market functions, own the reporting when it doesn't impact their performance per se, it's almost like a third party taking a look at the data and just reporting on what they're seeing, not trying to put a a spin or a story behind the data, just being as objective as possible about what's happening. Really important for revenue operations to own that, and really use that data to make business decisions. So the typical things you would see funnel metrics, your conversion, cycle data, create a pipeline, bookings performance, all of the key measurements that you're looking for, to make sure things are running well, should be coming from RevOps.

The one I'll end with which I think some RevOps teams are getting there, but a lot of RevOps teams don't lean in as much as I think they should, and probably don't realize how well equipped they are to lean in on this area is, Go-to-market planning and go-to-market strategy. What better team who understands all the business processes, understands the data in and out to help create the overall Go-to-market plan. So when I was internal as a head of RevOps at the companies I was at, I worked hand in hand with the CEO helping to put together what the plan should be, understanding where the Board wants the company to grow, where the management team wants the company to grow, and then translating that into an operating plan. So if you want to maintain these growth rates at these profitability levels on this timeline, these are the types of investments it would take in order to achieve that. And here's how we can operationalize it and then providing a few different scenarios for the leadership team to make a decision on this is when I think your RevOps team goes from fulfillment of requests from the go-to-market teams to being a strategic partner to the CEO, COO, CFO, and helping lead the business to the next level.

MATT DURAZZANI : Yeah, absolutely. No, I think it's very well said. I'll touch upon the the very last thing you said, because I think it relates probably in a very practical way to a lot of our operators, which is, you said, you know, you transitioning from a fulfillment type of role to more of a strategic one. And I think that's a very important element. And so a question for you is while organizations oftentimes struggle in getting the type of resources and time to achieve all the need of fulfillment requests. How do you help those operators maybe build the use case, value to the leaders, or to to be able to transition away from being just tactical, to then mature into more of a consulting strategic element as well.

ANTHONY ENRICO : Yeah, that's a great question. I think couple of aspects to it. One, some organizations are reluctant to invest in RevOps. And I I think that's one aspect. So, in order to turn revenue operations into a strategic business function, you need the right type of people to lead it. and people who are business minded, strategic minded, and can organize the resources to make things happen. But I think some companies are seeing the value, and some companies still see it as a cost center. And when that conversation comes up, usually what we help them understand is make sure your go-to-market teams are focused on the highest leverage practices that they can focus on. So if you have a VP of sales, as an example, spending time sifting through reporting, spending time figuring out why salesforce isn't working. That's time they could spend in market that's time they can spend with customers, that's time they can spend training their their new team members or recruiting the best people to join the sales team and I could share the same thing along customer success and along marketing. You know, you want to hire those experts who are masters of their craft of what you need them to do and all of this operational burden keeps them from performing those higher leverage tasks.

MATT DURAZZANI : Yeah, I like that one where you know, just re simplify it for people - focus on the highest value leverages that you can pull. An example is if reporting is very tedious and manual, If you can find a way to automate and simplify it, Now you're providing them to do their job with clients in other areas of the business that'll be all held back because information is not available. So that's just one of the example, right? So look into your organization, and talk to your leaders and figure out what are probably the biggest pains that you could try to go and solve for and try to deliver on those, and I think that will start building that value that people in leadership are looking for. So well said. Okay,We can start looking into some of these metrics that you prepare for us today. We're excited.

ANTHONY ENRICO : Let's do it. Let's do it. So I hope I hope these metrics give some inspiration for somebody who might be in a RevOps role, maybe you're just starting out and thinking you know I've been told I need to get better data, but what what are some things a little bit more advanced than the typical reporting you'd see, that I can create that, to really add business value, really hoping it's for that. Or if you're a go-to-market leader, and you want to know what type of data you may need access to, to make decisions. I I hope this gives you some guidance. I have 3, and I'll start with this one.

So, for a lot of people, I think they would have seen pipeline coverage before Essentially you look at your quota on a given period, then you're looking at how much pipeline do you have to achieve that particular quota. Let's say this is looking out at Q2. So we're looking at Q2's quota and how much weighted pipeline and weighted pipeline being usually it's weighted by stage. If it's an earlier stage, it's not going to count as much in your pipeline overall number, If it's closer to closing that number typically increases. So it's a way to normalize some of that early funnel activity. And then just what total pipeline do you have access to? What are all the deals that could possibly close within this time period?

So many companies will look at this in an aggregate, so they'll look at it at the business level. They'll say we have this quarter target that I'm reporting to the board. Here's all of our weighted, here's all the un-weighted. There's a lot of different ways. You could segment it and slice and dice it, and and drill down. But I think one of my favorites, especially for B2B is really looking at this at the rep level which should be aligned to your territory level as well. You can look at it by rep or territory. And I do this because it usually gives you a lot of information that you weren't expecting. So if I'm looking at any given rep on the team, I can see who's likely to hit their number, who is likely to miss their number, and then it gives me a lot of insights to how I've designed territories, and if there is any need to shift investment. So I like the breakdown we have here. What types of business decisions could you make when looking at the coverage that you have for one rep over another.

And this takes a little bit of business context, so that you know as a leader, if you're a VP of sales looking at this. I think you're gonna have to make a judgment. Let's take Rep 5 as an example. They have the lowest amount of coverage. You're gonna have to make a judgment - is this a poor performer? Or did we design the territory poorly? At least this will give you an identification early on whether this person is going to hit their number or not. So you don't want to wait until after the quarter's already passed to decide If rep 5 is set up for success, or if they're a good rep for the team or not. So this will give you their their pipeline coverage, are they building enough pipeline to hit their number?

MATT DURAZZANI : Sorry a quick question on this one, you were just mentioning a moment ago that one of the business decision you can make is

what type of shift in investment do we need to make. When you use the word investment, can you give us an example what you mean by that?

ANTHONY ENRICO : Yes, couple of areas you can invest. One is people. The other would be marketing spend. So you can align some of your marketing spend to territories depending on how your territories are designed. Are you investing in the right geographies? Investing in the right verticals or segments? So it could be a mix of people or marketing spend mainly

MATT DURAZZANI : Okay, perfect thanks for clarifying. Go ahead.

MATT DURAZZANI : So if I look at this metric for a second, just to understand it and read it correctly, would you say, for instance, Rep 1 has potentially too much pipeline? Is that one of those you would say, maybe this is a territory that offers so much, but not enough boots on the ground to be able to deliver that much potential. Is that what you're saying?

ANTHONY ENRICO : It's a good question. As most things, it depends. What you should do is look historically to see how much coverage reps needed to attain their goals if they needed 2, 3, 10 times pipeline to quota. That'll give you an idea of, if they have enough for forward looking quarters.

MATT DURAZZANI : Great. That's a great metric definitely something important to to look at it, and and it's to your point very important if we do it more of at the rep level versus just aggregate it as a team, right? You don't really know how to determine the right prescription within the organization if you are just combining everybody in the same situation. So very well said.

ANTHONY ENRICO : Thank you. Yeah, moving on to the next one. So we call this the lead source impact matrix. And I think one of the most difficult things to do, and i'll add to this, most difficult, especially in B2B is understanding the performance of your marketing channels and we put this simple matrix together that really helps you understand which lead channels are your highest performing because there's a lot of different definitions of performance, and I'm going to explain how if you only used one, it might not tell the whole story. So this matrix maps two different metrics. One is the conversion rate of the lead source. So the 2 classic ways to do it are conversion from marketing qualified lead to sales qualified lead, or conversion from sales qualified lead to closed won.

In this case I did a closed won conversion amount, but you you could build the same metrics for any conversion across your go-to-market lifecycle. So we have lead source conversion, and then we have the amount closed won from that particular lead source.

So if you're in a meeting and somebody said, hey, what's what's our best performing lead source? A lot of people may be inclined to say, paid marketing because it's brought in the most closed won deals. You may also get a few people saying no, referrals are our best lead source, because it has the highest level conversion and maybe nobody would say SDR Outbound. But when you put it onto a matrix where you can see both at the same time you can start to see the high performing quadrant is up in the top right, where your SDR Outbound lead source is converting at a very, very high rate, maybe slightly less than referrals, but still very high performing conversion, and it's creating a high level of impact. So clearly you're able to invest in this particular channel and get more from it.

Then looking at the other quadrants, you know, paid marketing, yes, it's creating a massive massive impact. However, the conversion rate is rather low relative to the other lead sources that you are measuring. So you may be spending a lot of money that could be more efficient in other channels. So if you shifted some of that investment from paid marketing maybe brought on another SDR or 2, That's something that could help. The lower left corner, let's use webinars as an example. If it's not converting or having much of an impact, maybe it's taking too much time for your marketing team or sales team, Maybe you're making a lot of investment in this area and it's really not yielding the results you need. It might be worth shifting your time somewhere else. The hardest quadrant to identify and I'm gonna bring this back to - "this takes a good leader to understand the business context" is the bottom right. Very, very high converting but low impact. And you'd ask yourself why? The typical guidance would be invest more in these lead sources, if and only if they're elastic, meaning you have the ability to affect them. So I put a couple down there as an example- Events, we get leads from events. They're converting at 60%. We can likely find other events with similar audiences that we can go to, and it's going to be fruitful and likely be worth the investment. Referrals - you may be able to increase the type of referrals you're getting, and you may be able to do a few things. You may be able to put out a program to your customer success team, or you know, start to request for referrals.

However, that has a really limited amount that you can continue to fuel. There's only so much you can do to try to get more referrals. So you have to understand the elasticity. How much can you move these lead sources around. If you put more investment to it, How much more could you get out of it? A few ones are easy to understand like paid marketing SDR's, spend more in marketing, hire more SDR's, do more events. But some of them you may just not be able to get more out of.

MATT DURAZZANI : Hey, I love this metric, and and I love the fact that you're you're focusing directly on the closed won amount. A question that might come up from some of the operators, especially if they are, for instance, marketing operators, could be that, oftentimes market organizations and their complaints are tied to be able to bring the top of the funnel down to maybe an accepted opportunity and a sale, and they don't often have a comp plan or a responsibility, because they would assume a lot of risk, and very little influence to be able to drive all the way to closed won for most organizations, right? And so, if a marketing operator, not a sales operator, looks at this type of metric they're like, well, we do a lot of efforts here in paid marketing, but how is it that just outbound efforts actually are more effective?

In your experience, do you have any advice on how maybe those marketing operation sides can, or have you seen done, that it can improve that conversion rate all the way to the bottom of the funnel versus what maybe an outbound AE or SDR can produce on their own?

ANTHONY ENRICO : Yeah, so I I want to make sure. I understand the question.

What have I seen marketing teams do to increase the conversion rate of some of the lead sources?

MATT DURAZZANI : Yes.

ANTHONY ENRICO : that's a great question. I think everybody's trying to figure out ways they can enhance the conversion. I know this might sound very rudimentary, but spending more time in market, spending more time collaborating with your sales team and customer success teams and getting more feedback, I think is the best way to have inspiration for what's working. I you know you need to really make sure your messaging is relevant. You need to make sure you're going to events where the events are matched with your ICP, you have decision makers at events. Paid marketing, if you are more of a velocity sales type of business model, you may be able to do some more A/B testing and be able to understand which ads are resonating well with your with your market. But I think at the end of the day, understanding your offering, what product and service you you're putting out to the market, understanding the market, understanding the buyer journey, understanding the customer journey, and then spending time with your teams that are getting feedback, or spending time with customers and prospects, will give you the inspiration to develop better content, develop better webinars, go to better events.

MATT DURAZZANI : I think it's a solid advice. Thank you. Let's jump into the third metric here

ANTHONY ENRICO : This one comes from a bit of a personal experience, you know, as a head of RevOps, I would always have a CEO ask me what's the most we can close this quarter? What's the most we're going to do this quarter?

And then I'd have the CFO calling me saying, hey! what's worst case scenario like?

How how could this quarter go sideways? And we we don't do what we need to do?

And I always found that it was a little difficult to answer those questions directly, and this was the best tool that I had to create what I call the bounds of possibility, I think of this as a bookings number. if you're forecasting your bookings for a particular quarter, what do you think that number will be. And I put 2 different metrics against each other. So the first. What's the conversion rate of your current pipeline? This may be more relevant, depending on the time period. I'm using a quarter as an example. So let's assume your sales cycle is at least 90 days. So you have pipeline kind of slated for the next quarter. Well, the first thing I look at okay, what pipeline do we have right now? And what do we typically convert. And then what's one standard deviation plus and minus from that? And then that creates a pretty good bound of what you can expect to convert with your current pipeline. And then the next one is how much pipeline do we typically create and have the ability to close within the quarter. We're in market, we're running ads, we're doing things like we're going to get more pipeline as we go. How much can come in in this particular timeframe.

And then you can follow the same conversion. So okay, given our current pipeline, plus if we bring in X amount more pipeline, this is where we could close the quarter. And it really creates this, I would say understanding, that if you look at the center blue dots, if you're a CFO or CEO, maybe the CEO wants this slightly higher when its $434,000, and the CFO is looking at the slightly lower one. But it really gives you an understanding - this is how we typically convert. This is what we typically create. There's no reason I should expect abnormal over performance, unless you have some reason to, or abnormal lower performance.

But you could also be prepared to keep those in your realm of possibility, if you will.

So what business decisions does this drive? One. it it really helps you plan, spend in investments. So if you look at this and you want the number to be higher. Well then, you may need to invest in activities that can drive it higher. And also make sure that it could align with your hiring plan, it could align with your marketing budget. It could align with a lot of things. If you're a leader, this helps you control the story ahead of time. So get ahead of any good news or bad news that may be coming your way. So if you're ahead of revenue, and your CEO is asking what number you might be hitting. Having data behind it to show them. Usually they're not happy with the answer, by the way. So if I say, hey, we're going to close $400,000. Usually they'll say No, go get more.

But this helps explain here's why we're going to close it and here's what we're doing about it. So communicating potential performance outcomes earlier is really really important and having some logic to how you're getting to the number typically resonates. I say the benefits of this. It removes any superhero expectations from the forecast. You know every rep always has the 10 million dollar deal that's about to close this and that. But

it takes that away from being an expectation. And if it happens great, you can celebrate later. And then the biggest thing is, it just avoids any major surprises. You know,

CEO's and boards don't like to be surprised. The best board meetings I've ever been in, have been the most boring board meetings ever. So I haven't been in one yet where they were surprised, and it was a it was a good thing.

MATT DURAZZANI : I I was just smirking here while you were saying some of these things because I think, a lot of operators I can relate to what you said. The 2 that kind of stood out to me is one the the difference between the financial approach of a CRO versus CFO.

Where a CRO may say what is the best we can do versus CFO, what is the bottom line, the very least, the bare minimum that we can do? Just because of the conservative approach versus the over optimistic right. And this provides a very common ground for those 2 type of sometimes polar opposite personalities in the way they look at revenue to kind of come together and provide an an even playing field for them to operate upon. And then I also like the element of really using the data to provide a proper realistic narrative ahead of time. I agree with you that the best board meetings are the ones that don't have any major surprises right. That's when you avoid escalation, unnecessary pressure. So, looking ahead, you call it forecasting sensitivity, I also almost look at it like looking down the road, looking into the future sensitivity, right, and mitigate those obstacles. So I I really love this metric, I think is a very smart one to to put in place. So thanks for sharing this one. I do have one question about it, and and that is, In your experience, Does this type of visualization change much between the beginning, the middle, and towards the end of a quarter, or it stays fairly consistent, based on the way it's set up from a metrics perspective?

ANTHONY ENRICO : I usually will do standard deviations on each one. So we'll look back at the last 3 quarters or so, and then when I'm looking at. So right now as we're filming this, it's we're in Q1, So I'd be doing this for Q2 likely. And it shouldn't change too much, unless something dramatically changes in your business or go-to-market motions, or you launch a new product. And this data might not one to one translate to that performance, I would expect it to be smooth. But, sales is sales, and sometimes we can't predict everything. But at least getting a closer sense to the truth is usually worth the effort.

MATT DURAZZANI : Very correct, very correct. That's awesome. Anything else that you would like to mention about this matter before we kind of wrap it up?

ANTHONY ENRICO : If you're in a revenue operations role or and analytics role, These are the types of things that you can surface to your executive leadership team that really starts to put you in that strategic position, and they will be going to you for answers of predicting the future. I think when it comes to moving into a leadership role it has more to do with your ability to make judgments and predict. And the more you focus on data that can help you do that, the more influence I think you'll have across the organization. So feel free to steal these and just, you know, use them for yourself.

MATT DURAZZANI : Haha that's also now, that's a very good advice.

Okay, Anthony: so this is. This has been really helpful.

First of all, thank you. This is super insightful, and I think anybody that is trying to replicate, I think the last one particularly, I will love to test my myself because I think there's a lot of good insight and and maybe bring you in to kinda get perspective on how to look at the data, but I wanted to ask for a couple of more pieces of advice for you for the community.

If someone is maybe an analyst and they are thinking of trying to grow into that operational role, what type of positions or roles would you suggest them getting experience in, so then, one day, maybe they can be ahead of operations that they can expose themselves early in their career.

ANTHONY ENRICO : That's a great question.

There's so many diverse paths that people take to get into revenue operations.

but I could list a couple of different ways. One, if you have interest, go in the field. spend some time as a CSM, spend some time as a SDR, spent some time as a sales rep. I think, if you do that, it will give you the type of experience that will inspire you to have better ideas on an operational role. You may not want to do that, then what I'd recommend is spend time with those roles, shadow what they do. Ask them how things are working. I think some of my best ideas have come from sitting down with a person and just saying what really sucks about your day? What's annoying? You know the systems annoying as the comp plan not set up right. What? Just doesn't make sense here? Usually people will have an idea or two, and we'll be willing to share. And from there I would say, don't be afraid to make recommendations to make things better. So if you have an idea of hey, this process could be slightly better. hey we should measure this a little bit differently, I think this would be more informative. Maybe we should hire this role instead of this role first, because I think we have more need over here.

I would just recommend to always feel empowered to have a voice, shoot out your ideas. You know they don't all have to be right. They don't all have to be massive innovations, either. I think if you're making a little bit better every single day, then that's gonna compound over time, and you'll notice you'll make you look back a couple of years and notice what a big impact you've made.

MATT DURAZZANI : I love it. I think it's a very good advice. So let me flip the coin now for a second. Think about of a senior person, someone that is running these these group of operations. Sometimes there's the stigma of just let them cruise and let him stay in the roles right. Sometimes there are leaders that want to keep specific individuals in a specific roles because they don't want to lose the ability to solve for a specific problem, right?

So the question to you is, for those leaders that are managing these people,

what is some advice to help them develop, help them grow, so that

they can really maximize their potential and their expertise?

ANTHONY ENRICO : Yes, I I think if you're asking how to maximize the potential of a current leader in seat, one never be afraid of somebody over performing and then promoting that person because you'll either promote them or somebody else will, and they'll go somewhere else anyway. So either way, you might lose that person in that particular role that you feel really secure about having them fulfill. And then the other one is the more you can leverage teams, other people and power others, the more you can accomplish. I was very open at the beginning of this talk. I'm not a salesforce admin, I'm not a hubspot admin I never have been. Maybe I'll learn it some day. But I've surrounded myself with people who have complementary skill sets that can fill my gaps. and I would look for those people to join your team. Really understand where your strengths are, and where your where your gaps and weaknesses are, and then understand, if you don't want to invest in in filling those week business or gaps then make sure you bring along people who can.

MATT DURAZZANI : That's really good advice, and for which we Thank you! So, Anthony, this was fantastic. Thank you for your help. Everyone, if you will love to connect with Anthony Enrico, you can find them on LinkedIn, and I'm sure you can find information through the organizations. This has been a wonderful podcast today and we thank you for your time and and good insight, and we wish you all a great day.

ANTHONY ENRICO : Thank you so much, Matt. Appreciate it.

MATT DURAZZANI: Hello everyone! And a special welcome to Anthony Enrico. We're very excited to have you today. You're a great addition to our Revenue Maverick program. So welcome.

I'm Matt Durazzani, your host and I'm a Revenue Maverick adviser. And for the audience, I will love to introduce you for a moment to Anthony. He is currently the CEO and founder of leanscale. Anthony spent his career in operations in a number of organizations. and in those experiences he realized the need for expertise that are unique to this type of role, and after a decade spent solving similar problems and always new ones. He decided to start his own organization, to be able to serve more businesses and spread his knowledge and advisory work to others.

Anthony, today for the program, we would like to hear from you a little bit briefly about your organizations, and how people can get in touch with you. And then we would love to transition to understanding how you look at revenue engine holistically, as well as sharing with ours the 2-3 metrics that you felt you wanted to share with the community today. So, without further ado, the floor is yours

ANTHONY ENRICO : Well, Matt. First of all, thank you so much for having me. Really excited to be working with you on Revenue Maverick, and I think this is a really a really important topic that a lot of people are interested in. So I'm happy to provide some context here on the Revenue Operation side. I could give a little bit more background, so people know how I got into revenue operations. I think that's interesting for a lot of people, since it's fairly new. But I had a eclectic background, and in B2B SaaS Go-to-market role. So a little bit of sales, a little bit of customer success, a little bit of marketing, and then eventually found my way in a formal RevOps role, which I always have an interest in the operations side of any role I was in, and took my role as an operator. So that's how I got into it. I think that might be interesting for people who are trying to break into revenue operations, or you may be a leader in a go-to-market team looking for your next revenue operations upcoming star as well.

MATT DURAZZANI : I think that's a very good point that you, You were explaining the fact that sales operations is not the only route, you can come from other backgrounds but ultimately to be very well rounded, you want to have an experience in solving and supporting those different pillars in the organization

ANTHONY ENRICO : Absolutely, absolutely. And if you have some experience in the field. I think it helps you build a lot of empathy for the teams that you're helping support. So if you're in a sales or CS or marketing role right now, looking to get into operations, I think It's definitely a good avenue. You don't have to start there for sure.

And, Matt, I can give you a little bit of background on me, too. So some of the stuff I present this may give more context to how I view the world. So, as Matt mentioned, my co-founder and I, started lean scale after we had done revenue operations at a few different startups, and began to see the repeatability of some of the processes we were leveraging, and we also knew that it took a few different skill sets to set up the whole foundation really well. In particular, somebody who is technically sound with the systems, so usually that salesforce or Hubspot being able to connect all the go-to-market tools, and then someone who can think about the business holistically and understand how the processes should be operating. And how do you report on a business to articulate the performance of the go-to-market engine that you're building? So those 2 skill sets, I didn't have both, I was always on the business process side, and reporting an analytics side, new enough to be dangerous on salesforce and Hubspot, but definitely wouldn't consider myself a a pro on that side. So what leanscale does is we combine 2 types of people to provide a full RevOps operating team for our customers. So you could think of it as robots as a service, fractional RevOps.But we focus on B2B companies that are looking to grow and scale, and help take the whole operational burden off the plate of the go-to-market teams, and then empower them with all the data they need to make business decisions

MATT DURAZZANI : Awesome! Thank you.

ANTHONY ENRICO : Well, now, I think I could start if you think it's a good time with what I think RevOps is, because it's a little nascent. I think it's still, it's a new business function. People are still trying to define what it means and what it is, and everybody has their own definition, but I can share mine for what it's worth.

MATT DURAZZANI : Yeah, please do

ANTHONY ENRICO : So I've always thought of revenue operations. One, I think there's a big distinction between Sales Ops, Marketing Ops, CS Ops, and then full RevOps. Full RevOps from my perspective is looking holistically at the business - the whole lead to cash process, the customer management process and journey. And then, making sure that you have systems set up that can support the entire go to market engine, which is a big responsibility. I think it's been developed because a lot of processes and tools get siloed within some of those go-to-market functions and often it creates a lot of in-fighting within teams. It creates a lot of issues with reporting and definitions. So we're seeing RevOps continue to to build and grow. And for me I think there's 3 main areas that a RevOps team should function in. I'm going to start with obvious one. I'm going to start in the middle. So the operations aspect of it, meaning do processes align? How do people do the things that they do? How are compensation plans set up? How are the tools connected? Which tools are you using? What's the overall tech stack strategy? So all of the processes, systems, and tools definitely something that needs to be owned by revenue operations and help see across all the departments and understand how the whole flow should work. That's clearly a core competency. The other aspect, I think is just as important, is the go-to-market analytics. So having a function that sits across all of the other go-to-market functions, own the reporting when it doesn't impact their performance per se, it's almost like a third party taking a look at the data and just reporting on what they're seeing, not trying to put a a spin or a story behind the data, just being as objective as possible about what's happening. Really important for revenue operations to own that, and really use that data to make business decisions. So the typical things you would see funnel metrics, your conversion, cycle data, create a pipeline, bookings performance, all of the key measurements that you're looking for, to make sure things are running well, should be coming from RevOps.

The one I'll end with which I think some RevOps teams are getting there, but a lot of RevOps teams don't lean in as much as I think they should, and probably don't realize how well equipped they are to lean in on this area is, Go-to-market planning and go-to-market strategy. What better team who understands all the business processes, understands the data in and out to help create the overall Go-to-market plan. So when I was internal as a head of RevOps at the companies I was at, I worked hand in hand with the CEO helping to put together what the plan should be, understanding where the Board wants the company to grow, where the management team wants the company to grow, and then translating that into an operating plan. So if you want to maintain these growth rates at these profitability levels on this timeline, these are the types of investments it would take in order to achieve that. And here's how we can operationalize it and then providing a few different scenarios for the leadership team to make a decision on this is when I think your RevOps team goes from fulfillment of requests from the go-to-market teams to being a strategic partner to the CEO, COO, CFO, and helping lead the business to the next level.

MATT DURAZZANI : Yeah, absolutely. No, I think it's very well said. I'll touch upon the the very last thing you said, because I think it relates probably in a very practical way to a lot of our operators, which is, you said, you know, you transitioning from a fulfillment type of role to more of a strategic one. And I think that's a very important element. And so a question for you is while organizations oftentimes struggle in getting the type of resources and time to achieve all the need of fulfillment requests. How do you help those operators maybe build the use case, value to the leaders, or to to be able to transition away from being just tactical, to then mature into more of a consulting strategic element as well.

ANTHONY ENRICO : Yeah, that's a great question. I think couple of aspects to it. One, some organizations are reluctant to invest in RevOps. And I I think that's one aspect. So, in order to turn revenue operations into a strategic business function, you need the right type of people to lead it. and people who are business minded, strategic minded, and can organize the resources to make things happen. But I think some companies are seeing the value, and some companies still see it as a cost center. And when that conversation comes up, usually what we help them understand is make sure your go-to-market teams are focused on the highest leverage practices that they can focus on. So if you have a VP of sales, as an example, spending time sifting through reporting, spending time figuring out why salesforce isn't working. That's time they could spend in market that's time they can spend with customers, that's time they can spend training their their new team members or recruiting the best people to join the sales team and I could share the same thing along customer success and along marketing. You know, you want to hire those experts who are masters of their craft of what you need them to do and all of this operational burden keeps them from performing those higher leverage tasks.

MATT DURAZZANI : Yeah, I like that one where you know, just re simplify it for people - focus on the highest value leverages that you can pull. An example is if reporting is very tedious and manual, If you can find a way to automate and simplify it, Now you're providing them to do their job with clients in other areas of the business that'll be all held back because information is not available. So that's just one of the example, right? So look into your organization, and talk to your leaders and figure out what are probably the biggest pains that you could try to go and solve for and try to deliver on those, and I think that will start building that value that people in leadership are looking for. So well said. Okay,We can start looking into some of these metrics that you prepare for us today. We're excited.

ANTHONY ENRICO : Let's do it. Let's do it. So I hope I hope these metrics give some inspiration for somebody who might be in a RevOps role, maybe you're just starting out and thinking you know I've been told I need to get better data, but what what are some things a little bit more advanced than the typical reporting you'd see, that I can create that, to really add business value, really hoping it's for that. Or if you're a go-to-market leader, and you want to know what type of data you may need access to, to make decisions. I I hope this gives you some guidance. I have 3, and I'll start with this one.

So, for a lot of people, I think they would have seen pipeline coverage before Essentially you look at your quota on a given period, then you're looking at how much pipeline do you have to achieve that particular quota. Let's say this is looking out at Q2. So we're looking at Q2's quota and how much weighted pipeline and weighted pipeline being usually it's weighted by stage. If it's an earlier stage, it's not going to count as much in your pipeline overall number, If it's closer to closing that number typically increases. So it's a way to normalize some of that early funnel activity. And then just what total pipeline do you have access to? What are all the deals that could possibly close within this time period?

So many companies will look at this in an aggregate, so they'll look at it at the business level. They'll say we have this quarter target that I'm reporting to the board. Here's all of our weighted, here's all the un-weighted. There's a lot of different ways. You could segment it and slice and dice it, and and drill down. But I think one of my favorites, especially for B2B is really looking at this at the rep level which should be aligned to your territory level as well. You can look at it by rep or territory. And I do this because it usually gives you a lot of information that you weren't expecting. So if I'm looking at any given rep on the team, I can see who's likely to hit their number, who is likely to miss their number, and then it gives me a lot of insights to how I've designed territories, and if there is any need to shift investment. So I like the breakdown we have here. What types of business decisions could you make when looking at the coverage that you have for one rep over another.

And this takes a little bit of business context, so that you know as a leader, if you're a VP of sales looking at this. I think you're gonna have to make a judgment. Let's take Rep 5 as an example. They have the lowest amount of coverage. You're gonna have to make a judgment - is this a poor performer? Or did we design the territory poorly? At least this will give you an identification early on whether this person is going to hit their number or not. So you don't want to wait until after the quarter's already passed to decide If rep 5 is set up for success, or if they're a good rep for the team or not. So this will give you their their pipeline coverage, are they building enough pipeline to hit their number?

MATT DURAZZANI : Sorry a quick question on this one, you were just mentioning a moment ago that one of the business decision you can make is

what type of shift in investment do we need to make. When you use the word investment, can you give us an example what you mean by that?

ANTHONY ENRICO : Yes, couple of areas you can invest. One is people. The other would be marketing spend. So you can align some of your marketing spend to territories depending on how your territories are designed. Are you investing in the right geographies? Investing in the right verticals or segments? So it could be a mix of people or marketing spend mainly

MATT DURAZZANI : Okay, perfect thanks for clarifying. Go ahead.

MATT DURAZZANI : So if I look at this metric for a second, just to understand it and read it correctly, would you say, for instance, Rep 1 has potentially too much pipeline? Is that one of those you would say, maybe this is a territory that offers so much, but not enough boots on the ground to be able to deliver that much potential. Is that what you're saying?

ANTHONY ENRICO : It's a good question. As most things, it depends. What you should do is look historically to see how much coverage reps needed to attain their goals if they needed 2, 3, 10 times pipeline to quota. That'll give you an idea of, if they have enough for forward looking quarters.

MATT DURAZZANI : Great. That's a great metric definitely something important to to look at it, and and it's to your point very important if we do it more of at the rep level versus just aggregate it as a team, right? You don't really know how to determine the right prescription within the organization if you are just combining everybody in the same situation. So very well said.

ANTHONY ENRICO : Thank you. Yeah, moving on to the next one. So we call this the lead source impact matrix. And I think one of the most difficult things to do, and i'll add to this, most difficult, especially in B2B is understanding the performance of your marketing channels and we put this simple matrix together that really helps you understand which lead channels are your highest performing because there's a lot of different definitions of performance, and I'm going to explain how if you only used one, it might not tell the whole story. So this matrix maps two different metrics. One is the conversion rate of the lead source. So the 2 classic ways to do it are conversion from marketing qualified lead to sales qualified lead, or conversion from sales qualified lead to closed won.

In this case I did a closed won conversion amount, but you you could build the same metrics for any conversion across your go-to-market lifecycle. So we have lead source conversion, and then we have the amount closed won from that particular lead source.

So if you're in a meeting and somebody said, hey, what's what's our best performing lead source? A lot of people may be inclined to say, paid marketing because it's brought in the most closed won deals. You may also get a few people saying no, referrals are our best lead source, because it has the highest level conversion and maybe nobody would say SDR Outbound. But when you put it onto a matrix where you can see both at the same time you can start to see the high performing quadrant is up in the top right, where your SDR Outbound lead source is converting at a very, very high rate, maybe slightly less than referrals, but still very high performing conversion, and it's creating a high level of impact. So clearly you're able to invest in this particular channel and get more from it.

Then looking at the other quadrants, you know, paid marketing, yes, it's creating a massive massive impact. However, the conversion rate is rather low relative to the other lead sources that you are measuring. So you may be spending a lot of money that could be more efficient in other channels. So if you shifted some of that investment from paid marketing maybe brought on another SDR or 2, That's something that could help. The lower left corner, let's use webinars as an example. If it's not converting or having much of an impact, maybe it's taking too much time for your marketing team or sales team, Maybe you're making a lot of investment in this area and it's really not yielding the results you need. It might be worth shifting your time somewhere else. The hardest quadrant to identify and I'm gonna bring this back to - "this takes a good leader to understand the business context" is the bottom right. Very, very high converting but low impact. And you'd ask yourself why? The typical guidance would be invest more in these lead sources, if and only if they're elastic, meaning you have the ability to affect them. So I put a couple down there as an example- Events, we get leads from events. They're converting at 60%. We can likely find other events with similar audiences that we can go to, and it's going to be fruitful and likely be worth the investment. Referrals - you may be able to increase the type of referrals you're getting, and you may be able to do a few things. You may be able to put out a program to your customer success team, or you know, start to request for referrals.

However, that has a really limited amount that you can continue to fuel. There's only so much you can do to try to get more referrals. So you have to understand the elasticity. How much can you move these lead sources around. If you put more investment to it, How much more could you get out of it? A few ones are easy to understand like paid marketing SDR's, spend more in marketing, hire more SDR's, do more events. But some of them you may just not be able to get more out of.

MATT DURAZZANI : Hey, I love this metric, and and I love the fact that you're you're focusing directly on the closed won amount. A question that might come up from some of the operators, especially if they are, for instance, marketing operators, could be that, oftentimes market organizations and their complaints are tied to be able to bring the top of the funnel down to maybe an accepted opportunity and a sale, and they don't often have a comp plan or a responsibility, because they would assume a lot of risk, and very little influence to be able to drive all the way to closed won for most organizations, right? And so, if a marketing operator, not a sales operator, looks at this type of metric they're like, well, we do a lot of efforts here in paid marketing, but how is it that just outbound efforts actually are more effective?

In your experience, do you have any advice on how maybe those marketing operation sides can, or have you seen done, that it can improve that conversion rate all the way to the bottom of the funnel versus what maybe an outbound AE or SDR can produce on their own?

ANTHONY ENRICO : Yeah, so I I want to make sure. I understand the question.

What have I seen marketing teams do to increase the conversion rate of some of the lead sources?

MATT DURAZZANI : Yes.

ANTHONY ENRICO : that's a great question. I think everybody's trying to figure out ways they can enhance the conversion. I know this might sound very rudimentary, but spending more time in market, spending more time collaborating with your sales team and customer success teams and getting more feedback, I think is the best way to have inspiration for what's working. I you know you need to really make sure your messaging is relevant. You need to make sure you're going to events where the events are matched with your ICP, you have decision makers at events. Paid marketing, if you are more of a velocity sales type of business model, you may be able to do some more A/B testing and be able to understand which ads are resonating well with your with your market. But I think at the end of the day, understanding your offering, what product and service you you're putting out to the market, understanding the market, understanding the buyer journey, understanding the customer journey, and then spending time with your teams that are getting feedback, or spending time with customers and prospects, will give you the inspiration to develop better content, develop better webinars, go to better events.

MATT DURAZZANI : I think it's a solid advice. Thank you. Let's jump into the third metric here

ANTHONY ENRICO : This one comes from a bit of a personal experience, you know, as a head of RevOps, I would always have a CEO ask me what's the most we can close this quarter? What's the most we're going to do this quarter?

And then I'd have the CFO calling me saying, hey! what's worst case scenario like?

How how could this quarter go sideways? And we we don't do what we need to do?

And I always found that it was a little difficult to answer those questions directly, and this was the best tool that I had to create what I call the bounds of possibility, I think of this as a bookings number. if you're forecasting your bookings for a particular quarter, what do you think that number will be. And I put 2 different metrics against each other. So the first. What's the conversion rate of your current pipeline? This may be more relevant, depending on the time period. I'm using a quarter as an example. So let's assume your sales cycle is at least 90 days. So you have pipeline kind of slated for the next quarter. Well, the first thing I look at okay, what pipeline do we have right now? And what do we typically convert. And then what's one standard deviation plus and minus from that? And then that creates a pretty good bound of what you can expect to convert with your current pipeline. And then the next one is how much pipeline do we typically create and have the ability to close within the quarter. We're in market, we're running ads, we're doing things like we're going to get more pipeline as we go. How much can come in in this particular timeframe.

And then you can follow the same conversion. So okay, given our current pipeline, plus if we bring in X amount more pipeline, this is where we could close the quarter. And it really creates this, I would say understanding, that if you look at the center blue dots, if you're a CFO or CEO, maybe the CEO wants this slightly higher when its $434,000, and the CFO is looking at the slightly lower one. But it really gives you an understanding - this is how we typically convert. This is what we typically create. There's no reason I should expect abnormal over performance, unless you have some reason to, or abnormal lower performance.

But you could also be prepared to keep those in your realm of possibility, if you will.

So what business decisions does this drive? One. it it really helps you plan, spend in investments. So if you look at this and you want the number to be higher. Well then, you may need to invest in activities that can drive it higher. And also make sure that it could align with your hiring plan, it could align with your marketing budget. It could align with a lot of things. If you're a leader, this helps you control the story ahead of time. So get ahead of any good news or bad news that may be coming your way. So if you're ahead of revenue, and your CEO is asking what number you might be hitting. Having data behind it to show them. Usually they're not happy with the answer, by the way. So if I say, hey, we're going to close $400,000. Usually they'll say No, go get more.

But this helps explain here's why we're going to close it and here's what we're doing about it. So communicating potential performance outcomes earlier is really really important and having some logic to how you're getting to the number typically resonates. I say the benefits of this. It removes any superhero expectations from the forecast. You know every rep always has the 10 million dollar deal that's about to close this and that. But

it takes that away from being an expectation. And if it happens great, you can celebrate later. And then the biggest thing is, it just avoids any major surprises. You know,

CEO's and boards don't like to be surprised. The best board meetings I've ever been in, have been the most boring board meetings ever. So I haven't been in one yet where they were surprised, and it was a it was a good thing.

MATT DURAZZANI : I I was just smirking here while you were saying some of these things because I think, a lot of operators I can relate to what you said. The 2 that kind of stood out to me is one the the difference between the financial approach of a CRO versus CFO.

Where a CRO may say what is the best we can do versus CFO, what is the bottom line, the very least, the bare minimum that we can do? Just because of the conservative approach versus the over optimistic right. And this provides a very common ground for those 2 type of sometimes polar opposite personalities in the way they look at revenue to kind of come together and provide an an even playing field for them to operate upon. And then I also like the element of really using the data to provide a proper realistic narrative ahead of time. I agree with you that the best board meetings are the ones that don't have any major surprises right. That's when you avoid escalation, unnecessary pressure. So, looking ahead, you call it forecasting sensitivity, I also almost look at it like looking down the road, looking into the future sensitivity, right, and mitigate those obstacles. So I I really love this metric, I think is a very smart one to to put in place. So thanks for sharing this one. I do have one question about it, and and that is, In your experience, Does this type of visualization change much between the beginning, the middle, and towards the end of a quarter, or it stays fairly consistent, based on the way it's set up from a metrics perspective?

ANTHONY ENRICO : I usually will do standard deviations on each one. So we'll look back at the last 3 quarters or so, and then when I'm looking at. So right now as we're filming this, it's we're in Q1, So I'd be doing this for Q2 likely. And it shouldn't change too much, unless something dramatically changes in your business or go-to-market motions, or you launch a new product. And this data might not one to one translate to that performance, I would expect it to be smooth. But, sales is sales, and sometimes we can't predict everything. But at least getting a closer sense to the truth is usually worth the effort.

MATT DURAZZANI : Very correct, very correct. That's awesome. Anything else that you would like to mention about this matter before we kind of wrap it up?

ANTHONY ENRICO : If you're in a revenue operations role or and analytics role, These are the types of things that you can surface to your executive leadership team that really starts to put you in that strategic position, and they will be going to you for answers of predicting the future. I think when it comes to moving into a leadership role it has more to do with your ability to make judgments and predict. And the more you focus on data that can help you do that, the more influence I think you'll have across the organization. So feel free to steal these and just, you know, use them for yourself.

MATT DURAZZANI : Haha that's also now, that's a very good advice.

Okay, Anthony: so this is. This has been really helpful.

First of all, thank you. This is super insightful, and I think anybody that is trying to replicate, I think the last one particularly, I will love to test my myself because I think there's a lot of good insight and and maybe bring you in to kinda get perspective on how to look at the data, but I wanted to ask for a couple of more pieces of advice for you for the community.

If someone is maybe an analyst and they are thinking of trying to grow into that operational role, what type of positions or roles would you suggest them getting experience in, so then, one day, maybe they can be ahead of operations that they can expose themselves early in their career.

ANTHONY ENRICO : That's a great question.

There's so many diverse paths that people take to get into revenue operations.

but I could list a couple of different ways. One, if you have interest, go in the field. spend some time as a CSM, spend some time as a SDR, spent some time as a sales rep. I think, if you do that, it will give you the type of experience that will inspire you to have better ideas on an operational role. You may not want to do that, then what I'd recommend is spend time with those roles, shadow what they do. Ask them how things are working. I think some of my best ideas have come from sitting down with a person and just saying what really sucks about your day? What's annoying? You know the systems annoying as the comp plan not set up right. What? Just doesn't make sense here? Usually people will have an idea or two, and we'll be willing to share. And from there I would say, don't be afraid to make recommendations to make things better. So if you have an idea of hey, this process could be slightly better. hey we should measure this a little bit differently, I think this would be more informative. Maybe we should hire this role instead of this role first, because I think we have more need over here.

I would just recommend to always feel empowered to have a voice, shoot out your ideas. You know they don't all have to be right. They don't all have to be massive innovations, either. I think if you're making a little bit better every single day, then that's gonna compound over time, and you'll notice you'll make you look back a couple of years and notice what a big impact you've made.

MATT DURAZZANI : I love it. I think it's a very good advice. So let me flip the coin now for a second. Think about of a senior person, someone that is running these these group of operations. Sometimes there's the stigma of just let them cruise and let him stay in the roles right. Sometimes there are leaders that want to keep specific individuals in a specific roles because they don't want to lose the ability to solve for a specific problem, right?

So the question to you is, for those leaders that are managing these people,

what is some advice to help them develop, help them grow, so that

they can really maximize their potential and their expertise?

ANTHONY ENRICO : Yes, I I think if you're asking how to maximize the potential of a current leader in seat, one never be afraid of somebody over performing and then promoting that person because you'll either promote them or somebody else will, and they'll go somewhere else anyway. So either way, you might lose that person in that particular role that you feel really secure about having them fulfill. And then the other one is the more you can leverage teams, other people and power others, the more you can accomplish. I was very open at the beginning of this talk. I'm not a salesforce admin, I'm not a hubspot admin I never have been. Maybe I'll learn it some day. But I've surrounded myself with people who have complementary skill sets that can fill my gaps. and I would look for those people to join your team. Really understand where your strengths are, and where your where your gaps and weaknesses are, and then understand, if you don't want to invest in in filling those week business or gaps then make sure you bring along people who can.

MATT DURAZZANI : That's really good advice, and for which we Thank you! So, Anthony, this was fantastic. Thank you for your help. Everyone, if you will love to connect with Anthony Enrico, you can find them on LinkedIn, and I'm sure you can find information through the organizations. This has been a wonderful podcast today and we thank you for your time and and good insight, and we wish you all a great day.

ANTHONY ENRICO : Thank you so much, Matt. Appreciate it.

Jeremey Donovan

EVP, RevOps & Strategy

Watch the episode

Evan Randall

Senior VP, GTM Strategy & Ops

Watch the episode

Julia Herman

CRO

Watch the episode