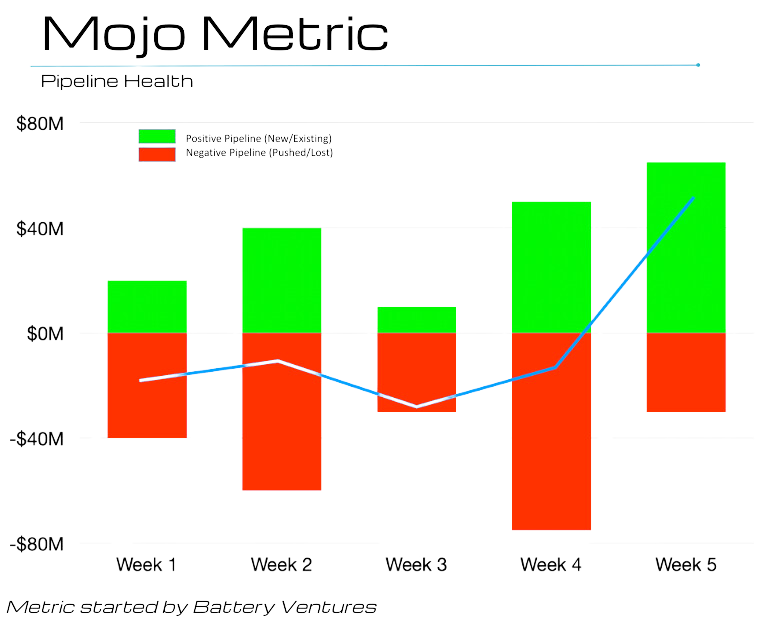

Metric 1: Mojo Metric

{color=#FFFFFF, opacity=100, rgba=rgba(255, 255, 255, 1), rgb=rgb(255, 255, 255), hex=#FFFFFF, css=#FFFFFF}

The Mojo Metric is a comprehensive performance indicator that evaluates both new and existing pipeline activities, tracks pipeline shifts, and monitors cases of pipeline reduction or loss. This critical tool is integral in assessing the efficiency of your pipeline generation, ensuring strategic decision-making and targeted efforts.

By analyzing key performance indicators with the Mojo Metric, businesses can swiftly highlight areas of strength and those requiring enhancement. This invaluable insight facilitates precision in forecasting, targets areas with promising potential, and mitigates any negative pipeline fluctuations. In essence, the Mojo Metric deciphers complex data, empowering businesses to focus on their ultimate objective - optimizing revenue.