The Revenue Blog /

Sales Forecast KPIs You Must Track to Ensure Accuracy

Sales Forecast KPIs You Must Track to Ensure Accuracy

Topics covered in this article

Must-Have KPIs to Track to Ensure Forecast Accuracy.

Peter Drucker is credited with the famous quote, “If you can’t measure it, you can’t improve it.” It seems simple, but there are still far too many things that are measured only by “gut” feelings and instincts. Of which, your sales forecast should not be one.

We gathered a panel of some of the best revenue and sales operations leaders, consisting of:

- Stephen Daniels, Head of Revenue Operations, Branch

- Victoria Moss, VP, Revenue Operations, Greenhouse

- Anu Krishnakumar, VP, Global Sales Operations, Smartbear

The group discussed how exactly they measure the accuracy of their sales forecasts. Here’s what they had to say. You can also watch the full recording at any time, here.

Use Your Quarterly Forecast Results to Drive Your End of Year Goals

Tori recommends that at the end of each quarter you re-examine your annual forecast through the lens of the quarterly results. Check and see if your yearly goals are still attainable, or if you will surpass them. Regardless of the outcome, this will either prevent an end of the year scramble to make forecast, or give support, onboarding, and/or success teams a chance to prepare for additional users.

Adjust Forecast Expectations Where Needed

For greater forecast accuracy, it is important to adjust your forecast KPIs to fit the needs of your situation. Two examples are within geographic regions or for different size companies.

Stephen breaks his forecasts up by NA, EMEA, and APAC. Each of those regions has different working cultures and therefore deals have different expectations. Applying the same sales cycle to all of them will only result in a less accurate forecast. To find the benchmark, he recommends applying a historical win rate.

Tori echoes the sentiment, recommending a best practice of breaking up your forecast by the company size. Such as the following:

- Small business - 30-day sales cycle. Forecast on deal volume and trends, calculated by opportunities x win rate x average account value.

- Mid-Market - Deal-by-deal forecast with a “gut-check” based on quota capacity.

- Enterprise - Deal-by-deal forecasting with weekly MEDDPICC-driven inspections by both directors and managers.

The KPIs You Should Use to Track Forecast Accuracy

Pipeline Coverage

"Pipeline coverage is table stakes,” says Anu. Every company should be looking to have between three to 5 times their forecast covered in their pipeline. Stephen adds that he calculates pipeline for different geographic regions based on the historical amount needed to meet expectations.

Forecast Categories and Movement

All the panelists agree that monitoring forecast categories and what was included, excluded, and why are important. If sales reps and managers are doing a proper job of forecasting, you should be able to gather good information about what will close, and what’s at risk.

Tori likes to look at what was called “likely” on day one of month one of each quarter, compared to day one of month two. She looks for deals that have been downgraded, and which ones have been added, and why.

Opportunity Age

Anu also likes to consider the age of an opportunity in these forecasts. If it starts to draw out for longer than the average sales cycle, he says that risk on it should be gradually increased. As extended deals are statistically less likely to close as time goes on.

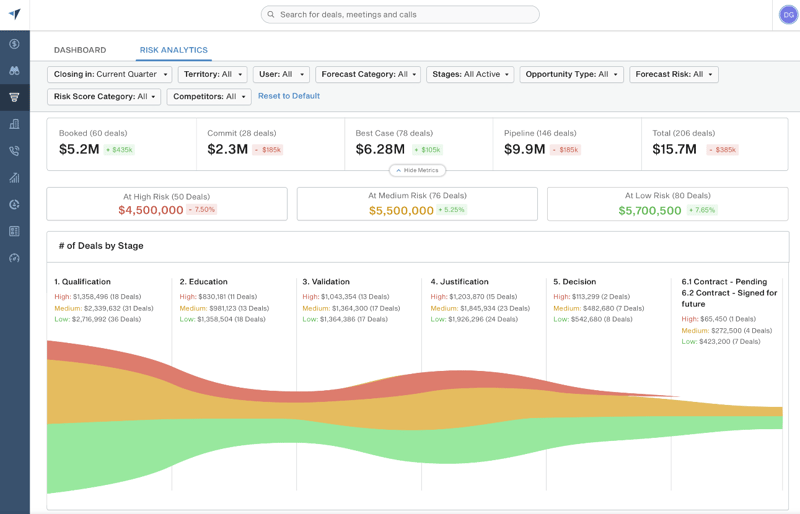

BoostUp Risk Score

Stephen also loves to use BoostUp’s AI risk score to judge the accuracy of his forecast. The AI monitors deal activity, including buyer and seller engagement through all sales channels to determine if there is meaningful communication occurring and if the deal is being progressed. If the forecast includes a lot of high-risk deals, it’s time to take action.

-Photoroom.png)