The Revenue Blog /

6-Step Template for Running Highly Effective Deal Review Meetings

6-Step Template for Running Highly Effective Deal Review Meetings

Topics covered in this article

Deal reviews are one of the most, if not the most important duties of sales managers. An effective and efficient deal review cadence, when properly executed, guarantees an increase in sales team performance.

Proper deal reviews answer key questions for the management and leadership, while also coaching sellers in improving deal progression and increasing win rates to eventually increase sales revenue.

In this article, we discuss six steps that are part of a highly effective deal review meeting:

- Inspect the overall pipeline

- Examine at-risk opportunities

- Review buyer and seller activities

- Dig into individual communications

- Inspect who is engaged in the deal

- Inspect key deal moments

How to Conduct a Deal Review Meeting

In many organizations, deal reviews are not done properly. They can be clumsy, inefficient, and miss key points that are required for success.

To extract as much value out of a deal review meeting as possible, teams should establish a standard cadence that focuses on the factors that impact the outcomes of opportunities.

These deal reviews should be quick, yet thorough, as to allow each manager enough time to meet with their reps once per week.

How can sales managers be fast, yet thorough at the same time? That’s where an Ro&I platform like BoostUp comes in.

BoostUp’s deal inspection and rep coaching utilizes AI to generate insights that not only allow for rapid deal inspection at a deep level but also helps managers coach better to increase rep performance.

Complete the review of a deal in two minutes with BoostUp. Watch the Video.

Deal Reviews using BoostUp

Deal review meetings occur between sales reps and their leadership team to review specific accounts and opportunities to determine the likelihood of a closed-won deal and to discuss possible strategies for getting those deals over the finish line. Using BoostUp, deal review meetings can become more effective and streamlined by following a simple six-step approach.

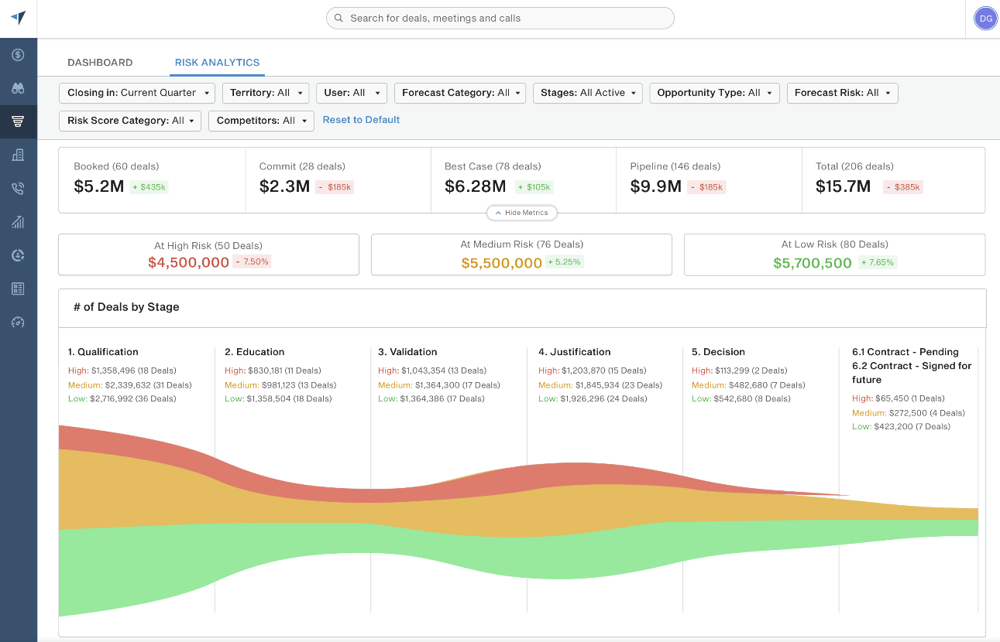

Step 1: Inspect the seller’s pipeline

For individual sellers, begin the deal review with the overall view of their pipeline. Answer the following questions:

- What pipeline stages are their deals in?

- What has progressed since last week?

- What has not moved?

- What deals are at risk?

BoostUp’s AI examines many factors about a deal, including the communications within it to create a risk score. Identify what deals are at risk.

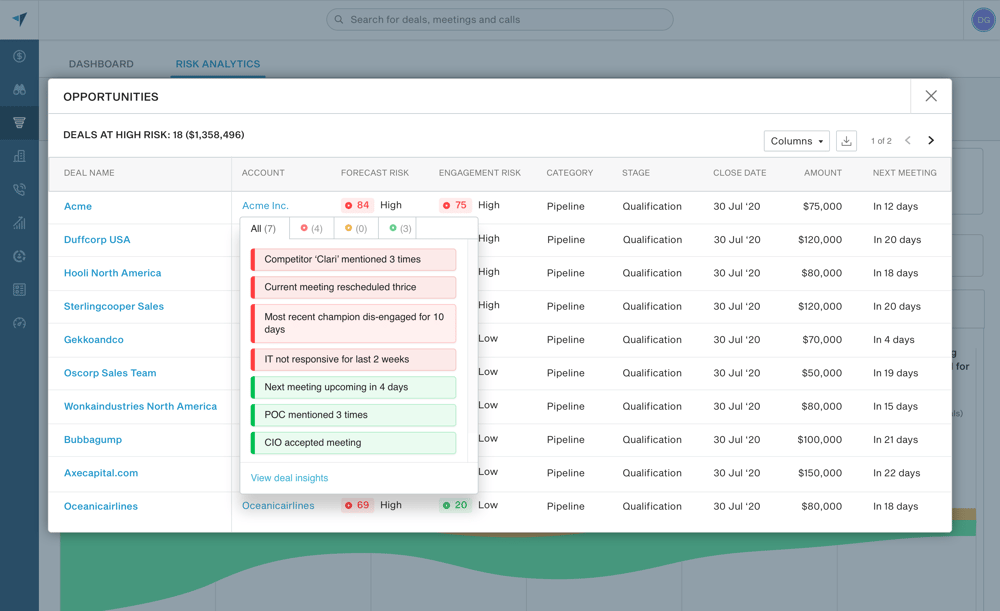

Step 2: Inspect At-Risk Opportunities

For opportunities that are at-risk, examine the factors that are contributing to the risk score. Deals can be at risk because of a lack of engagement, pushed meetings, slow progression, a lack of executive involvement, and so on.

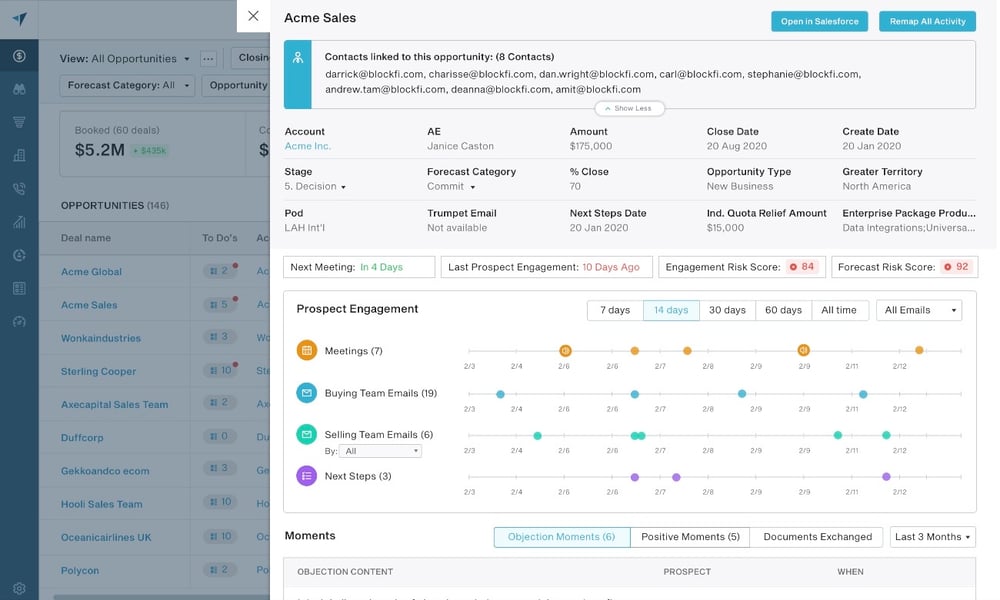

Step 3: Review Buyer and Sales Rep Activity

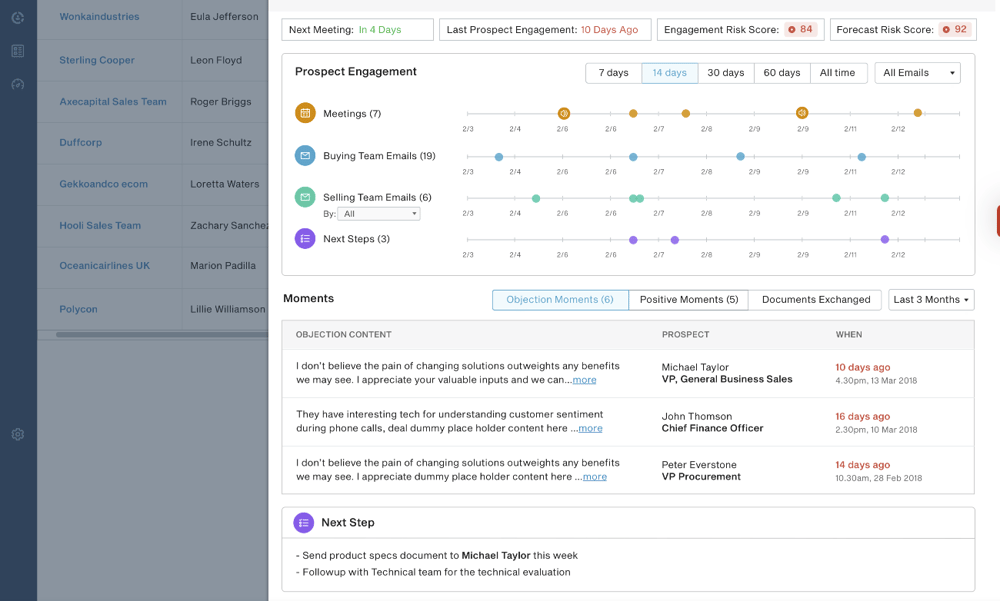

Further, diagnose an at-risk deal by examining the opportunity’s activity timeline. BoostUp plots out when emails were sent, meetings took place, phone calls happened, and when/what are the next steps planned in an easy to understand timeline view.

Activity should be spread evenly across the timeline, ideally with an increasing frequency as the deal progresses, indicating increased excitement and engagement. Be careful to look out for a lack of engagement on the buying side as well, checking for reciprocity of the sales rep’s actions.

Step 4: Dig into Individual Communications

After checking overall activity within an opportunity, you can continue to examine individual communications within BoostUp. The platform highlights keywords and actions that indicate positive or negative sentiment.

You can inspect these emails individually and also listen to relevant phone calls so you can understand exactly what is happening within a deal and coach the seller on how to proceed.

.png?width=1000&name=Submit_forecast_new18.4@2x%20(1).png)

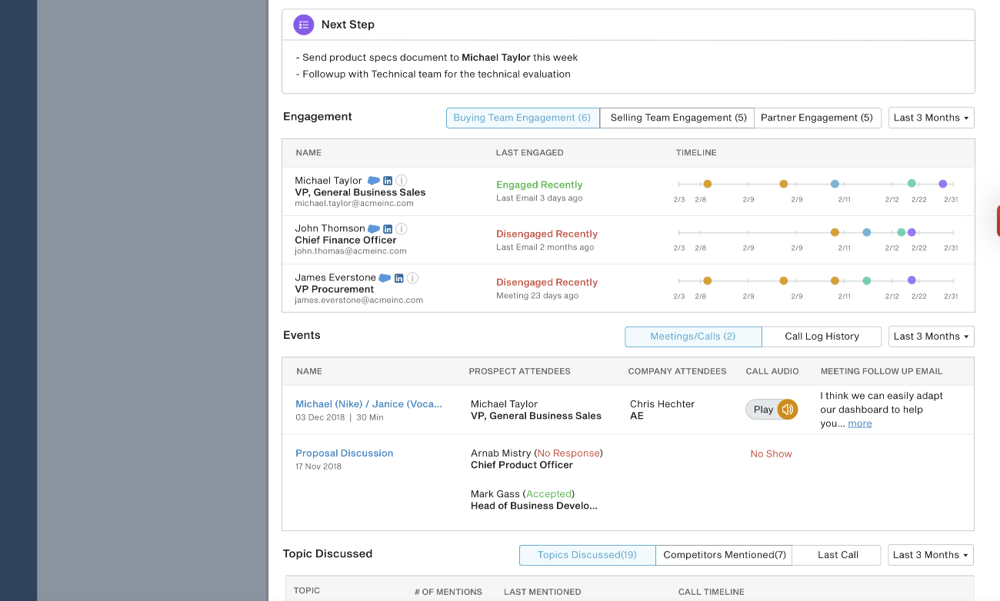

Step 5: Inspect Who Is Engaged in the Deal

The most successful deals engage as many relevant contacts on the buying side as possible. You should see a spread of both low and high-level contacts across multiple departments that are all actively engaged.

If the deal is at risk, understand why someone relevant is not engaged and discuss further on how to get them involved.

Step 6: Inspect Key Moments in Detail

Use BoostUp’s keyword timeline to see when things like a demo or pricing were discussed, what the sentiment was, and if there were objections.

Understand which competitors are involved in the deal and if they are still actively being discussed. Also, see when and how positive moments occurred in the past and figure out how to capitalize on them in the future.

Skip the interrogation, the back and forth communications, and focus on strategy, next steps, and outcomes. By using these metrics in BoostUp, managers can rapidly inspect a large number of deals and provide actionable and valuable insight to their reps.

Conclusion

This six-step approach while using a tool like BoostUp can help you move beyond the regular interrogation-like deal review process, to a more nuanced deal review cadence that focuses on improving strategy and formulating next steps backed by relevant engagement and activity data. By using BoostUp’s deal inspection and coaching capabilities, managers can rapidly inspect a large number of deals and provide actionable and valuable insights to their reps to improve deal progression and overall win rates

-Photoroom.png)