Topics covered in this article

Sales processes and technologies have evolved rapidly over the last decade. Both tools and methodologies are being introduced to ensure companies hit their forecast quarter after quarter. While this progression of how we as sales professionals close business has been a part of most sales teams across the world, the way that sellers and managers review their deals has been much the same as it has always been.

Effectively reviewing deals, and building plans to keep them on track is one of the most critical pieces of any successful sales team. Knowing that deal reviews are critical, leveraging technology to improve the efficiency and effectiveness of these reviews would seem to be a no-brainer.

In this playbook, we will cover:

- 5 Keys to Successful Deal Review Meetings

- The Benefits of a Well-Defined Process

- 5 Key Elements of a Successful Deal Review

- Tips for Setting the Deal Review Cadence and Framework

- 6 Areas of Deal Review Triangulation

5 Keys to Successful Deal Reviews

- Have a well-established, defined, communicated and adoption sales process.

- Ensure managers know how to determine where AEs are in the process.

- Vary your deal review meetings and frequency based on where you are in the quarter.

- Know the benefits and limitations of technology for deal reviews. Ask yourself, do you have the tools you need?

- Constantly learn from your deals and integrate your process to get better.

Benefits of a Well-Defined Sales Process

- Deliver the best value and experience to the customer

- Gives you the best chance to predictably win larger deals at higher win rates

- Allows AEs to know what is required of them at each stage to advance the deal

- Allows managers to provide the best coaching to their team members

- Drives cross-functional alignment for better outcomes

- Allows you to learn faster as a company to iterate and improve quicker

5 Elements of a Success Deal Review

|

Element |

Questions to Answer |

|

Account Overview |

|

|

Opportunity Scorecard |

|

|

Health Scorecard |

|

|

Relationship Map |

|

|

Action Plan |

|

Setting the Deal Review Framework

When establishing your modern deal review playbook, it's essential that you look at it in context with all other revenue meetings you have, including your forecast and pipeline review meetings.

Establishing a framework and a cadence is essential so that everyone knows who is involved in each meeting, what's their role, what to expect, and the overall goal or outcome of the meeting.

Here is an example framework that you can start leveraging today if you don't have something in place already.

|

Event |

Audience |

Goal |

Cadence |

|

Set the Forecast (Monday morning) |

|

Confirm monthly/quarterly commits

Drive escalations |

1x week |

|

Review Pipeline Opportunities |

|

Confirm underlying commits

|

1x week |

|

Deal Reviews |

|

|

1x+ week |

|

Pipeline Review |

|

Review weekly/monthly/quarterly goals

|

1x week |

6 Areas of Deal Review Triangulation

In this section, we will take a look at the modern deal review enabled with technology and provide a playbook to improve your deal reviews in order to drive results within your organization. We will be focusing on 6 areas that will help you find the deals needing review, understand what is and isn’t happening in the deal cycle, who is involved, what is being discussed, and provide all the data needed to get a deal back on track.

1. Start with the sellers' pipeline to determine which deals to review.

Not all deals need to be reviewed, nor should most sales leaders be required to review every deal. There are factors or indicators that should be considered when determining where a sales leader should spend time in reviewing deals, so what factors should we consider when deciding which deals to deep-dive on?

What pipeline stages are current quarter deals in? You’ll want to take into consideration where you are compared to your target, and how much time is left in your month/quarter when doing this analysis. It’s obvious, but more often than anyone would admit, it’s overlooked. Understanding what deals are actually in play for your forecast period is the first step in managing your time and effort wisely. It’s also where you can clean up your in-quarter pipeline quickly. The key here is detachment: forget what your sellers told you about that bluebird deal, forget about what you need to hit your number just for a second.

What has a real possibility of closing? Objectively look at the stages, where do you really have a chance, and where are your outliers? The outliers should be moved. The deals where you have a real shot are the first candidates for review.

2. Review "at-risk" opportunities.

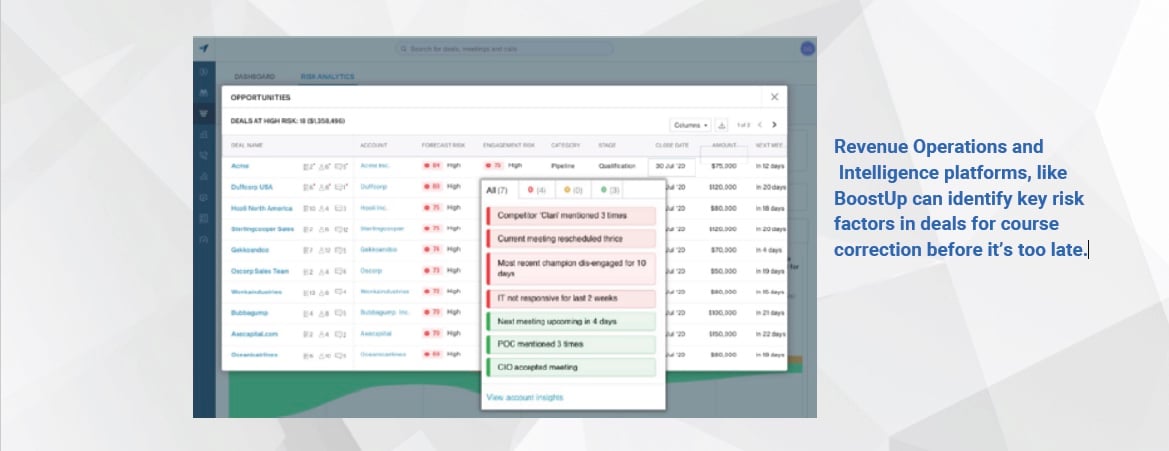

After understanding what is in your sellers’ pipelines, understanding what is mature enough to close, what’s moving, and what isn’t. We can start looking at the relative risk of the opportunities in play. Technology can start to play a factor in modernizing your deal review practices here.

Without technology injected into your process at this point, it’s possible this will take quite a bit of time to do effectively. What needs to happen is determining what drives risk in your pipeline, and in what deals are those risk factors prevalent. If you have standard documentation, some type of validation methodology, or a well-defined and detailed sales process, you may be able to put together risk factors manually. That said, technology is the best way to modernize when trying to understand risk at both the deal level and in aggregate across your pipeline.

Risk can come from multiple factors, but as a best practice, you should look at opportunity data, its change over time, as well as buyer and seller behavior from the perspective of engagement and sentiment. Being able to look at an opportunity and the activity happening around it is the key to understanding where the risk lies in a deal, and what to do to course-correct it.

Once risk is defined, focusing on high and medium-risk deals will put your effort where the greatest return is possible. Low-risk deals are what sales reps discuss the most with their leaders, but need the least amount of time and effort from leadership.

High-risk deals generally come in 2 forms: either they aren’t quite baked yet and need to be pushed to a future period, or something has gone sideways and they need to be marked as lost. There are some outliers with high risk, these are the deals that can be saved if the right plan and enough effort is applied. Medium-risk deals are where you can make the biggest impact on your revenue and forecast.

These are the deals that have the potential of being saved. They are also the deals with the greatest chance to get you to meet or exceed your goal if you can execute appropriately.

3. Review buyer and seller activity.

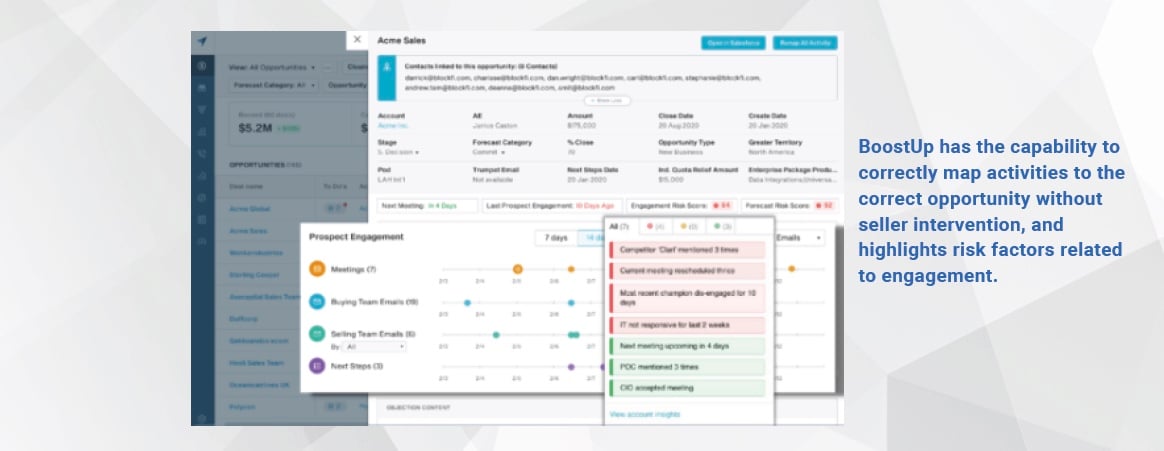

At this point, we have a group of deals needing a deeper review. Now it is time to start digging into the details, starting with activities related to these opportunities. When looking at activity in opportunities more isn’t always better, the key here is in the name of the step buyer and seller activity. It’s good to know that you have reps that are willing to hustle to get a deal done, but if you see activity on one side of the equation and not the other, you may have a problem. The focus here should be on finding the places where either we aren’t communicating with the customer, or the customer isn’t communicating with us.

Technology can be your friend here. Accurately capturing and allocating activities to an opportunity is no trivial task, especially when dealing with a complex organization. Multiple opportunities per account, several stakeholders per opportunity, and lots of overlap can cause issues. Finding the right technology to do the mapping, or manually deploying the correct methodology makes all the difference. What you want to look for when reviewing activity levels is reciprocal engagement. Is the customer talking back to us at a rate that is appropriate for the level of communication we are using with the customer?

This isn’t a one-size-fits-all, depending on the role of your contact on the buying side different levels of communication are expected. Don’t expect a C-level executive to be sending you daily communications no matter how often you are engaged with them. That being said, if you have a champion who is helping you move the deal across the line, they should be fairly active in communicating with you and your team. Understanding the appropriate buyer behavior will make a big difference when digging in and reviewing deals.

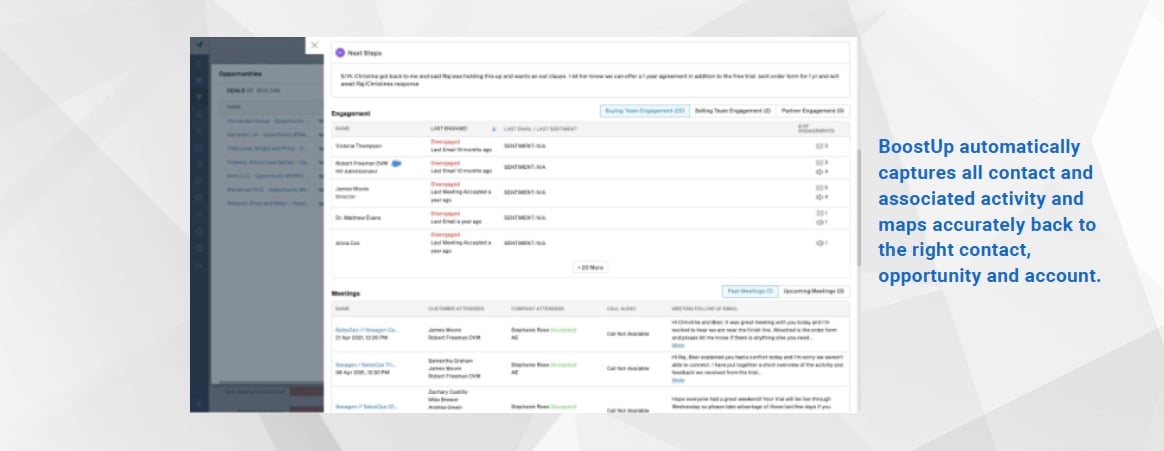

4. Inspect who is involved in the opportunity.

Understanding who is involved will give you a direct look at how healthy a deal really is. Research around sales and the sales cycle suggests that there should be 6-8 people involved on the buying side of the sales cycle to increase your likelihood of success, and that number seems to be growing. Making sure your sellers have gotten deep and wide enough in the organization they are selling is a critical factor in ensuring you can get deals across the line. Another piece of that puzzle, however, is who these people are.

Every deal should have people on the buying side that can play a role in your successful deal. Making sure that your touchpoints in the buying org aren’t too siloed, or too low level to make a meaningful difference is something that should be focused on. Now, sellers can talk a big game about how good their champion is, or that they don’t need a strong case for leadership with this “one special deal” but being able to validate yourself will take you to the next level when understanding if you are engaging the right people at the right levels.

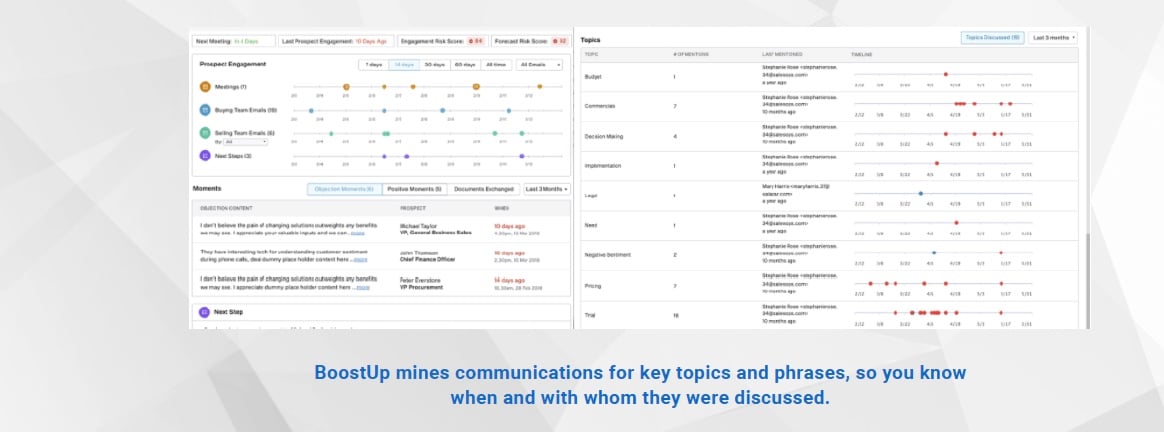

Leveraging a tool or system that can understand who is being spoken to and when is another way that you can save yourself time and effort, by having the information at your fingertips. Being able to inspect, understand and take action or make recommendations on the data available to you can be a game changer. While understanding who is involved and how often we are engaging can give you a directional idea of where a deal is headed or how healthy it is, understanding what exactly is being said is where the best plans can come to fruition.

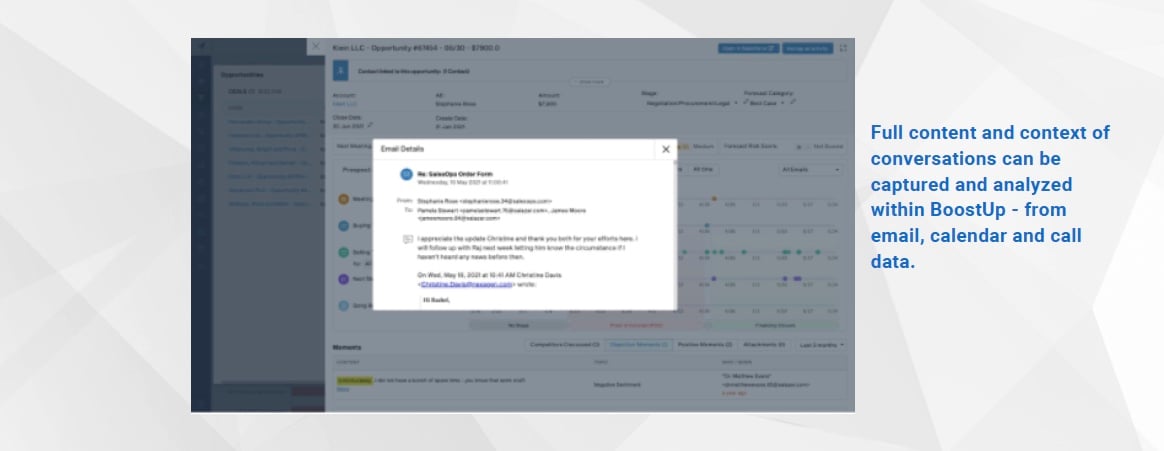

5. Review individual conversations.

After understanding the level of engagement between buyer and seller and who is involved in the cycle. It’s time to dig into individual conversations to understand the context and sentiment related to the deal. Not all communication is created equal. You may have good reciprocal engagement with your buyers, but if what you are getting back is overly negative, evasive, or otherwise not indicative of a deal progressing to closure, looking at only volume could be misleading.

Some things to focus on when reviewing conversations: key topics, sentiment, and competitive mentions. What is being said, when in the sales cycle and by whom are critical to understanding what if any progress is being made?

Technology, again, can be an ally here. With NLP and AI being available in so many tools, there are options to streamline your workflow rather than having to read through each individual email manually. Leveraging tools to do asynchronous review is another way to save time and still be able to dig into the details to understand what can be done to get a deal back on track, or if it is even possible.

6. Inspect key deal moments and next steps.

To this point, we’ve looked at the pipeline, risk, relative communication, people involved, and individual conversations. Now it’s time to understand if the right things are happening and if what we are planning next is the right move.

- What are the key actions that are needed to get a deal closed?

- Did we share the documentation needed?

- Have we started conversations with the security or legal teams?

- Are these things happening at the right time?

This is where the picture starts to become clearer on how real a deal actually is. Taking the modern approach to this problem once again can involve technology, the same NLP or conversational intelligence that helps you understand sentiment can help you understand if these key deal moments are happening and if they are happening at the right times. This is something that could take hours to do manually, and things would still slip through the cracks.

What should we target here? Keywords and phrases in emails related to these moments, documents shared and when, who was a part of these important moments, and what are we going to do next. If there are things needed that are unique to your business, now is the time to check for those as well. If you are going to use technology to solve this problem, you’ll want to make sure that the system you chose has the flexibility to be customized to suit your needs. Map out what has been done, what is planned to do next, and what still needs to happen. You will then have the details needed to plan ahead and take corrective action.

Deal reviews in the modern sales era need to change as our sales cycle has changed in order to move at the speed needed to keep up with the business. The day has passed when leaders could have 30-minute conversations with sellers about their largest deals and just take their word for it. There are tools and technology available to streamline this workflow, allow leaders to inspect deals, and take action without pulling sellers away from what we pay them to do: sell.

In Summary

In this playbook, we outlined the framework and cadences for success, the elements, and benefits of a successful deal review along with how technology can play a key role in standardizing your deal reviews, providing insights to help win more deals, and improve seller coaching and significantly reduce the time to perform deal reviews.

- Start with the sellers pipeline. Look objectively at their deals to determine what really has a chance.

- Review “At-Risk” opportunities to put your effort in the right places to maximize your return on effort.

- Review buyer and seller activity with a focus on reciprocal engagement, including who is involved in the conversations.

- Understand who is involved both from the buyer and seller side to determine if the right people are involved.

- Inspect individual conversations to understand the context and sentiment being expressed by the customer.

- Review key moments and next steps to make sure the right things have happened, and the current plan will be effective.

Doing these six things will make a palpable difference in the results being produced by your sales organization, and leveraging technology is the quickest way to get to these results.

To learn more and see how BoostUp can help you forecast more accurately by providing you insights into the risk in your pipeline and deals, set up a demo at www.boostup.ai/get-demo/.

-Photoroom.png)